Debt Relief Programs in Louisiana

Steeped in rich history and lively traditions, Louisiana boasts a diverse cultural appeal. So, it’s no surprise that over four million people call the state home. Although Louisiana residents are in less mortgage and credit card debt than residents of other states, it’s residents rank second in the nation in automobile debt.

If you live in the Pelican State and are looking to pay off your bills, consolidate your high interest rates and get collectors off your back, consider enrolling in a Louisiana debt relief program.

How does Louisiana Debt Relief Work?

From parish to parish, debt relief is an option for all Louisiana residents. When you work with a Certified Debt Specialist, they will customize a plan that is perfectly tailored to fit your needs.

If you are struggling to pay multiple payments, have recently encountered a hardship or carry overwhelming amounts of unsecured debts, then Louisiana debt settlement may work for you. Debt settlement programs begin by negotiating with your lenders and creditors, and most often settling your debt for less than what is owed.

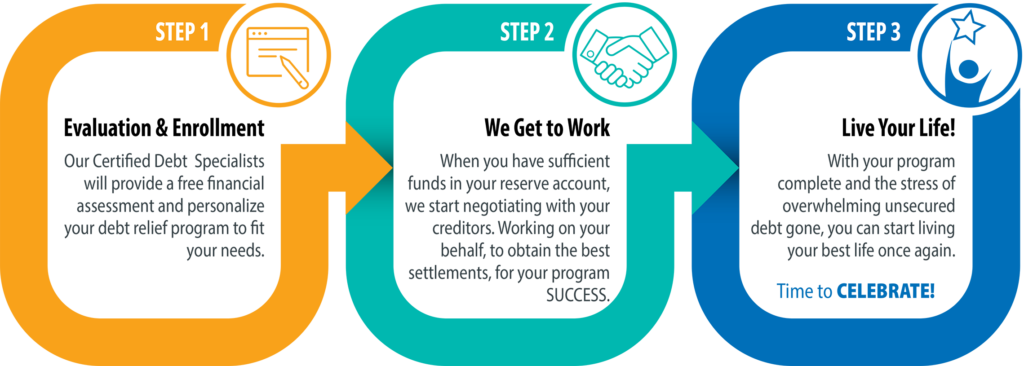

It's As Easy As 1, 2, 3 ...

Century’s focus is completely on you.

We are experienced in helping our client’s get on a path toward better financial health. Check out our easy, three step program below.

Debt Settlement vs Debt Consolidation

Debt settlement and debt consolidation are often confused, but they are actually two different programs that benefit unique situations. Debt settlement is a useful tool to resolve the total amount of debt owed by making one monthly payment, while debt consolidation involves taking out one loan to pay off other debts.

Although debt consolidation reduces the number of creditors you owe by rolling your debt into one consolidated loan, the total amount of debt owed remains the same. With debt settlement, a certified debt specialist will negotiate with creditors on your behalf to create a lower, lump-sum settlement.

Is Louisiana Debt Negotiation Right for Me?

If you, like many Louisiana residents are battling high interest credit card debt or balancing multiple creditors with high interest payments – debt settlement can help. When you work with the Century team, we will customize a plan that fits your unique situation.

Your program and it’s length, will be tailored based on the accounts you enroll, how much money you owe and how much you can budget for the monthly program payment. Century is here to help.

Let us negotiate better terms with your creditors, consolidate your debt and lower your monthly payment. You don’t need to go it alone.

What Types of Debt can be Settled in Louisiana?

From Jefferson to East Baton Rouge and every parish in between, most unsecured debts can be relieved in Louisiana. Because unsecured debts are not backed by collateral, they often carry higher interest rates, which can add up over time. Unsecured debts that can often be settled or consolidated include:

Credit cards

Utility bills

Personal loans

Need a Debt Settlement Company in Louisiana?

Century Can Help!

If you are a Louisiana resident who needs help with credit card or other types of unsecured debt, contact us for your free assessment.