Blogs

The link between mental and financial health are more connected than some may realize. Growing evidence reveals that financial strains and worries play significant roles in mental health. In the US, one in five adults lives with a mental illness, of which 7.8% experience major depressive episodes and 19.1% have anxiety disorders (Mental Health America, 2020). Worries about personal health and financial security are related to higher levels of psychological distress. This is an alarming trend, given that psychological distress is associated with several adverse health outcomes, and can manifest itself through physical symptoms such as anxiety, depression, compromised immune systems, high blood pressure and a feeling of being overwhelmed.

Genetic factors may also play a role in the development of these conditions. If you have a mental disorder, being aware of your condition so you can get the proper treatment is essential.

People who are struggling financially often have poorer diets, can fear losing their homes, and typically experience strong feelings of shame about not being able to provide for themselves and their families. Whether you’re planning for the future or managing existing debt, getting your finances in order is essential to your physical, mental and emotional well-being.

Financial stress can be isolating, leaving people feeling as if they are alone with their problems. Find someone who you can talk to about your concerns. They may not be able to fix your problems, but they should be able to listen to your concerns without judgement. Use this person as a sounding board for your ideas.

When you’re experiencing financial stress, you can be embarrassed and feel shameful. It can be challenging to reach out to family members and friends to share what you’re going through. However, you can trust that the people who truly care for you will be supportive, understanding, and compassionate. Shame is a very negative emotion that can contribute to your stress load.

If your finances are causing you stress, reach out to a financial advice service for help. Seeking help from a professional with the experience, knowledge, and solutions for your financial situation is an important step. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation, and money in the process.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

In honor of April’s National Financial Literacy month, a month dedicated to raising awareness about the importance of financial literacy, we’ve put together money management skills every adult should have to improve their financial outlook. Safeguard your financial future and avoid costly mistakes by following these basic tips.

1. Take Control

If costs are rising, take an honest look at your income and outgoings, and set some smart, realistic financial goals or targets that you want to achieve. Begin by listing the financial goals you have for the future. These may be modest and relatively short-term, like saving enough for a vacation. They might be urgent and essential, like clearing your smaller debts. The more specific your objectives, the more likely you are to make them a reality.

As with all goal-setting, make sure that yours are SMART goals.

2. Organize Your Accounts

Feeling in charge of your finances will make you feel more proactive. Getting organized now is a great way to stay on top of your finances. Do a little research to find the best bank deals for you. Banks may offer incentives, such as reduced fees or cashback, when you switch to them. Most banks offer free online banking, so you can keep on top of income and outgoings from your computer or mobile device. Others might have useful apps to track and manage your spending.

3. Create a budget

And stick to it. It may seem like a chore, but it’s an important part of the process. And it helps you to identify your income-to-debt ratio. The first thing to do is make a list of all your regular income. Second, list your essential expenditure, this includes mortgage or rent payments, water, electricity, food and health insurance. Third, make a list of all non-essential outgoings. These include leisure activities, cable plans and vacations. Finally, target your non-essential list first and see what you can reduce.

4. Manage Your Debts

Not all debt is “bad”. Good debt, such as a mortgage, can boost your credit rating and prove your reliability to lenders. Debt becomes a problem when responding to demands to pay it off are impossible. So, if you have something spare after the essential spending in your budget, consider getting ahead of your creditors and paying off your debts using either the “snowball” or “avalanche” method.

5. Control Your Spending

Know how to separate your must-haves from your nice-to-haves. That’s critical for proper money management. You need a clear picture of your monthly expenses — the money it takes to run your house, feed your family, power your car, and take care of your debts — and put those needs above all else.

Everything beyond that — dinners out, trips to the movie theater, even extracurricular activities for the kids — must come second.

If you’re worried about your ability to prioritize, the envelope budgeting method can be particularly helpful. You can also shop with only cash (this helps you avoid impulse purchases and makes sure that you only spend what you have). Or you may choose to direct deposit some of your earnings into savings, where it’s harder to access for impulsive purchases.

6. Pivoting

Sometimes things don’t work out as planned. Maybe a job falls through, you don’t get that raise you expected, or your rent goes up more than projected. It happens, and a part of good money management is learning to adapt to these unexpected financial mishaps.

This might, of course, mean tapping your emergency fund, determining where you can cut back on spending, or taking on a side job or extra hours if necessary. Having a plan for your money is important, but having backup options? That’s just as critical

7. Get Support

When you’re experiencing financial stress, you can be embarrassed and feel shameful. It can be difficult to reach out to family members and friends to share what you’re going through. However, you can trust that the people who truly care for you will be supportive, understanding, and compassionate. Shame is a very negative emotion that can contribute to your stress load.

Seeking help from a professional with the experience, knowledge, and solutions for your financial situation is an important step. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Everyone likes a better experience especially when it improves access to information about your program. To make using your MyCentury client portal easier, more informative, and more accessible, we’ve rolled out some changes to your experience.

How often do you worry about money? Financial anxiety can follow you everywhere in your everyday life, but not all financial struggles are equal. For one person, it may mean cutting costs on material items, like clothes, while for another, it may mean relying on a food pantry or a second job to cover household bills. Money worries can lead to stress, anxiety, and depression. They may even present themselves as physical symptoms including headaches, loss of appetite or not being able to sleep.

People who are struggling financially often have poorer diets, can fear losing their homes, and typically experience strong feelings of shame about not being able to provide for themselves and their families. Whether you’re planning for the future or managing existing debt, getting your finances in order is essential to your physical, mental and emotional well-being.

Let’s take a look at the 5 steps you can use to improve your personal financial well-being.

Take Control

Take Control

If costs are rising, take an honest look at your income and outgoings, and set some smart, realistic financial goals or targets that you want to achieve. Begin by listing the financial goals you have for the future. These may be modest and relatively short-term, like saving enough for a vacation. They might be urgent and essential, like clearing your smaller debts. The more specific your objectives, the more likely you are to make them a reality. As with all goal-setting, make sure that yours are SMART goals.- Organize Your Accounts

Feeling in charge of your finances will make you feel more proactive. Getting organized now is a great way to stay on top of your finances. Do a little research to find the best bank deals for you. Banks may offer incentives, such as reduced fees or cashback, when you switch to them. Others might have useful apps to track and manage your spending. In general, use a current or checking account to manage day-to-day transactions. Most banks offer free online banking, so you can keep on top of income and outgoings from your laptop or phone. - Create a Budget

And stick to it. It may seem like a chore, but it’s an important part of the process. And it helps you to identify your income-to-debt ratio. The first thing to do is make a list of all your regular income. Second, list your essential expenditure, which includes mortgage or rent payments, water, electricity, food, and health insurance. Third, make a list of all non-essential outgoings. These include leisure activities, cable plans, and vacations. Finally, target your non-essential list first and see what you can reduce.There are many free resources that can help with your financial well-being and alleviate your stress. For example, your employer may offer an employee assistance program. Online guides can provide free downloads and tools to help you build, track and adapt your budget.

- Manage Your Debts

Not all debt is “bad”. Good debt, such as a mortgage, can boost your credit rating and prove your reliability to lenders. Debt becomes a problem when responding to demands to pay it off is impossible. So, if you have something spare after the essential spending in your budget, consider getting ahead of your creditors and paying off your debts using either the “snowball” or “avalanche” method. - Get Support

When you’re experiencing financial stress, you can be embarrassed and feel shameful. It can be challenging to reach out to family members and friends to share what you’re going through. However, you can trust that the people who truly care for you will be supportive, understanding, and compassionate. Shame is a very negative emotion that can contribute to your stress load. If your finances are causing you stress, reach out to a financial advice service for help. Seeking help from a professional with the experience, knowledge, and solutions for your financial situation is an important step. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation, and money in the process.

If your finances are causing you stress, reach out to a financial advice service for help. Seeking help from a professional with the experience, knowledge, and solutions for your financial situation is an important step. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation, and money in the process.

Greg was a single father trying his best to provide a great life for his two kids. After separating from his wife, he had a bit of difficulty adjusting to a one-income household. Greg’s financial situation became even more difficult when his ex-wife lost her job and he had to pick up all the children’s expenses. He found himself being weighed down with thousands of dollars in credit card debt.

Greg was shocked at how a change in circumstances could result in debt becoming quickly out of control. The pressure started to become too much to bear, and Greg soon feared he may not be able to make the minimum payments and could eventually lose his home. He knew it was time to look for help.

A friend who had recently completed their debt relief program recommended Century. Greg had no idea what debt settlement was and having entered so many uncharted territories with his finances, he was apprehensive about entering into a program he did not fully understand.

The Century rep he spoke to was able to put his mind at ease by letting him know exactly how Century could help regain his financial health. “She (the Century rep) was amazing and took the time to explain everything to me and then called me back when I had other questions,” said Greg “I am beyond thrilled with Century.”

Century not only created a strategy that easily fit into Greg’s single income but one where he paid a fraction of his owed balances. Greg was elated to stop focusing on his debt and spend more time with his kids. “I have finally found someone who is upfront and personal with every step and conversation in this new journey. I will be able to put my life back together and move forward with confidence,” said Greg.

Just 22 Months later, Greg is living completely debt free and is looking to buy a house for himself and his kids.

Congratulations on your program success, Greg!

We thank you for trusting us to be a part of your journey toward better financial health and celebrate your diligence in staying with the program to make such great progress!

*We protect the privacy of our clients by changing their names and omitting any identifying details.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

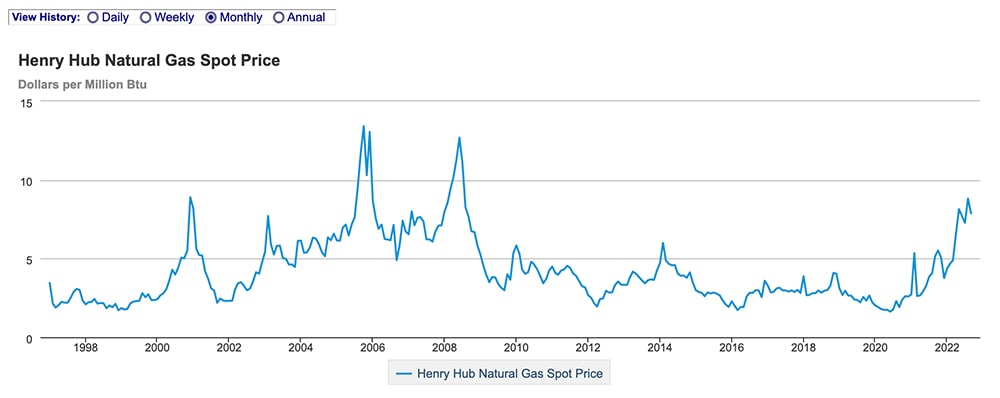

According to a recently released National Energy Assistance Directors Association (NEADA) report, home heating costs (across all fuel types) are projected to increase by more than 17%+ this year.

About 90% of the costs to heat (and cool) a home are economically tied to natural gas – either directly or indirectly, as natural gas is used to generate electricity. Natural gas prices have spiked to a fourteen-year high –

The increase has to do with complex economic metrics, like production slowdowns due to the pandemic, supply chain issues, etc. 2022’s overwhelmingly warm summer didn’t help when Americans cranked the A/C to beat the heat, driving prices higher even before winter arrived.

Tips to Help Reduce Heating and Utility Bills this Winter

With prices rising, it pays more than ever to proactively find ways to reduce utility and heating bills as the temperature drops.

1. Maximize Insulation

One of the most effective techniques to save money on heating costs is to avoid paying for heat that escapes needlessly. The attic is often the place where warm air escapes. Because insulation has the potential to dramatically lower energy bills, it eventually pays for itself. For tips, check out the Department of Energy’s step-by-step insulation tips and instructions.

2. Adjust Thermostat to Meet Daily Needs

Many families have busy lives, with children at school and parents working or attending to family needs. You can, however, lower your heating and utility bills by adjusting the thermostat down a few when no one is home- but remember to keep the home warm enough for family pets. You can put your heating objectives on autopilot with a programmable thermostat for a relatively small investment.

3. Adjust Water Heater Temperature

Lowering the maximum temperature of the home’s water heater can help to reduce utility bills because hot water is used for showering, washing clothes, and washing dishes. The default temperature for a water heater is 140 degrees Fahrenheit, which may waste more than $50/year. According to the U.S. Department of Energy, lowering the water heater temp to 120 degrees works for most and saves money.

4. Block Drafts From Doors

Exterior doors are often another culprit for heat loss during the cold winter, which unnecessarily drives heating bills higher. Even the slightest crack between the door and frame can let hot air out or push cold, frigid air inside the home. A rolled-up towel by the door works, but there are many creative and effective draft blockers for doors of all sizes.

5. Clean/Check Air Filters & Air Ducts

Dirty or worn-out air filters make your heating system work harder – adding to energy costs and maybe reducing the life of your HVAC system. Air filters are constructed from different materials, so determine which is best for your situation. Have the heating ducts and vents cleaned/serviced yearly because, over time, the airflow can be blocked by a buildup of dust and dirt.

6. Use Energy-Efficient Light Bulbs

According to Energy.gov, about 10% of a home’s electric bill can be sourced to powering lights. As you need to replace light bulbs, it is prudent to replace them with LEDs (ENERGY STAR Light Emitting Diodes), some of which last a decade.

7. Reduce the Times You Dine Out

Pro-Tip – Double Savings Alert – It is well-known that one saves on food bills by eating at home rather than dining out. However, in the winter, in addition to creating a warm, inviting aroma in your home, and saving on food costs, the heat emanating from your kitchen will help warm the surrounding areas in your home.

The holidays are fast approaching, and for most who are glad to see the pandemic in the rearview mirror – the holiday season is quite a welcome sight.

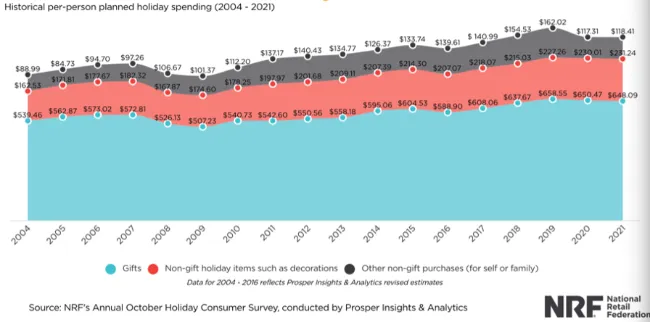

But with inflation, the holiday season has become an expensive end-of-the-year celebration. According to the NRF (the National Retail Federation), in 2021, the average consumer was planning to spend $998 on holiday-related food, gifts, and decorations. The following graph offers a historical look at holiday spending from 2004 to 2021–

And the above-noted dollar amounts do not include the costs required for holiday travel and other festivities of the holiday season. Add some very real global inflation (resulting in the shrinking purchasing power of the dollar), and it is not uncommon for holiday cheer to turn to holiday stress.

The good news is there are simple and effective ways to save during what should be a celebratory season filled with friends and family. Consider these clever techniques –

1. Shop Early or During the Offseason.

NRF’s report notes that, increasingly, consumers begin shopping for the holiday season earlier and earlier. In 2021, 61% of consumers started shopping by early November. This is an increase from 51% of early shoppers ten years earlier. The reasons for consumers to start shopping early include the following –

- Retailers have begun offering sales earlier and earlier in the season and even offering bargains for unsold items at a newly-defined sales event – Christmas in July.

- Starting early gives you more time to pay for the season’s expenses, among others.

2. Take Advantage of Black Friday & Cyber Monday

These two giant shopping holiday events offer deep discounts on large-ticket items but also provide savings on holiday decor, crafting supplies, and the always-needed batteries.

3. Check Out What Thrift Stores Have to Offer.

Thrift stores have always had a strong following; however, their popularity has increased as they offer such fabulous and unusual finds for shoppers who love to just hunt down interesting items to be reused. The best time to find holiday items at thrift stores is usually after the holidays when individuals donate unwanted items rather than pack them away until next year.

4. Forage in Nature.

Holiday decorating can include elements of nature that can be found by walking in or around wooded areas. Most suburban yards offer acorns, pinecones, and evergreen shrubs that can brighten up any holiday décor in an eco-friendly way.

5. Do-It-Yourself Projects Can Involve the Whole Family.

Grabbing some craft materials at the local dollar store is a great way to decorate for the holidays and include everyone in the decorating process. From painted pumpkins to Christmas ball vases to stringing popcorn/cranberries or evergreen garlands, your imagination is the only limiting factor. Check out Martha Stewart’s simple step-by-step instructions for making paper snowflakes.

6. Re-purpose Old Objects

There are many ways to use existing items in new creative ways. For example, craft an unusual lighting effect by taking a string of lights and tucking them into a see-through vase. Not only will you be reducing your carbon footprint, but there is also no cost to reuse something you already own.

7. Use Non-Traditional Decor

Not every decoration has to fall within a traditional holiday theme of red ribbons and light strings. Be creative and display some of your favorite things in a vignette or a dedicated mantelpiece.

8. Buy Used Online

The digital marketplace now offers many websites dedicated to selling previously owned goods. From Etsy to eBay and Craigslist, there are limitless ways to purchase preowned holiday (and non-holiday) merchandise that can help you save money decorating.

When you’re working hard to pay off your debts, stress can weigh on you. The day-to-day stress of managing your finances and other responsibilities can have serious health consequences.

Financial uncertainty can impact your health in several ways, including:

- Heart Disease. Stress can increase your blood pressure, your heart rate and the levels of cortisol in your bloodstream

- Sleep Disorders. Insomnia, nightmares and fitful sleep can prevent you from getting the restorative REM sleep we all need to function well

- Diabetes. Stress can affect your likelihood of developing diabetes. Stress can have an impact on your blood sugar, which can affect you in different ways

- Emotional Health. Financial stress can lead to depression and anxiety, which can make it difficult to concentrate, focus or be productive

Here are some helpful tips for reducing your financial stress.

Tip #1: Make a Budget and Stick to It

Living within your means is an important strategy when paying off your debts. A weekly and monthly budget helps you plan and organize your spending, including your bills, debt repayment obligations, groceries and discretionary spending. Once you make a budget, it’s important to track your spending and adjust accordingly.

Tip #2: Forgive Yourself

Everyone makes financial mistakes in their life. Dwelling on those mistakes can have a real negative impact on your health. Forgive yourself for the mistakes that are in the past and give yourself credit for the work you’re doing now to get out from under your debt burden. Mindfulness exercises, such as deep breathing, can help greatly in keeping your mind at ease.

Tip #3: Use Available Free Resources

There are many free resources that can help with your financial well-being and alleviate your stress. For example, your employee may offer an employee assistance program. Online guides can provide free downloads and tools to help you build, track and adapt your budget. Your local library will have books available on smart financial management. All of these free resources can help you feel in control of your financial and emotional health.

Tip #4: Take Advantage of Free Activities

Having fun does not need to be expensive. There are plenty of low- and no-cost activities for individuals and families that can help you relax and recharge without breaking the bank. Parks, hikes, bike rides, board games, binge-worthy television shows and hobbies are great ways to relieve stress and save on your spending.

Tip #5: Get Sleep and Exercise

Stress can make you feel worn down and unable or unwilling to do the things you enjoy. Sleep and physical exercise are important ways to combat the stressors in your life. Even a brisk walk daily can help you clear your head and give you some energy. And sleep is important, too. Make sure you turn off smartphones and other devices before you get in bed, avoid caffeine before bedtime and schedule regular times to sleep each evening.

Tip #6: Get Support from Friends, Families and Professionals

When you’re experiencing financial stress, you can be embarrassed and feel shameful. It can be difficult to reach out to family members and friends to share what you’re going through. However, you can trust that the people who truly care for you will be supportive, understanding and compassionate. Shame is a very negative emotion that can contribute to your stress load.

Seeking help from a professional with the experience, knowledge and solutions for your financial situation is an important step. During Stress Awareness Day on Nov. 2, 2022, take steps to be kind to yourself and manage your stress effectively.

A few years ago, Jeffrey went through a divorce and started applying for apartments. He discovered that his credit score had plummeted due to old utility debts that had resurfaced, and landlords were refusing to rent to him. Jeffrey was unaware that his ex had opened utility accounts in his name and failed to pay them.

After a long battle trying to resolve the debt, it was found to be valid, and he owed tens of thousands. “Shortly after the breakup, I received a call about one of the bills and paid it over the phone without realizing that I was bringing this old debt back to life” Jeffrey stated. “That mistake cost me thousands”.

This term is called Zombie debt and most people don’t realize that it can “rise from the dead” even after it has been removed from your credit report. Fortunately, Jeffrey was able to find Century Support Services to help him with his debt relief. “When I thought I had exhausted all of my options, I found Century” Jeffrey exclaimed “They were able to personalize a debt settlement program that I could afford. I found a roommate to help offset the landlord issues and am working on repairing my credit.”

You should be wary of debt collectors who call you about a very old debt. Collectors who buy up old debt sometimes try to trick consumers into making payments they no longer have a legal obligation to pay. When you make a payment on a very old debt, you accept liability for it, and the debt clock starts over!

Although Jeffrey is just in the first couple months of his estimated 42-month program, he is happy with his success so far. Jeffrey has had his first settlement and Century is working hard to get the rest of his debts resolved as well. “I feel like I can breathe again. And although my situation could have been much worse, I greatly appreciate Century for being there for me and helping me out of a rocky situation,” said Jeffrey.

Congratulations on your program success, Jeffrey!

We thank you for trusting us to be a part of your journey toward better financial health and celebrate your diligence in staying with the program to make such great progress!

*We protect the privacy of our clients by changing their names and omitting any identifying details.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

When you are in a debt-relief program or are considering a debt-relief program, it is important to create a budget. Don’t forget to include holidays and birthdays in the budget. With the holiday season fast approaching, many will find it difficult to have the holiday they want – not only because of trying to repair their credit or get rid of debt but because of the overall condition of the economy. You can still have a wonderful holiday season and not go into debt again.

Create a Budget

If you didn’t account for the holiday season when you created your budget, create a holiday budget now. Look through your expenditures for the past six months and determine what you could cut – at least temporarily. Or, if you did account for holiday spending in your budget but would like a little more, you can temporarily cut other spending.

Pick Up a Side Gig

Many places are starting to hire for the holiday season. You can earn some extra money for the holidays by working an extra part-time job for a couple of months. If you can find a work-from-home gig, that’s even better. Many companies still allow employees from home, though you may have to go to the office for training.

Keep Kids’ Expectations Low

Manage your kids’ expectations for a huge haul by focusing on meaningful gifts. If they are smaller but mean more, the kids won’t notice that the gifts are smaller. Depending on the number of kids you have, you might set a limit on the number of gifts. If you can manage four, choose a gift your child really needs, a gift he or she really wants, something special to wear and something special – a hobby, reading, toy the child wants.

Look for Free or Low-Cost Activities

Instead of heading to an expensive play, look for free or low-cost activities that could be even more fun. Sometimes, cities have holiday concerts that are free. Look for tree-lighting events, or even take a drive around the neighborhood at night to look at everyone’s decorations. Many cities hold holiday parades. If your town and a nearby town have parades on different days – these are usually prior to the actual holiday – attend the parades for a fun day.

Avoid In-Store Credit Card Offers

While it might be tempting to get an in-store credit card just for the discount, having that card encourages you to spend outside of your budget. These cards usually have high-interest rates on top of the hassle of paying another monthly payment. They also “encourage” you to spend outside your budget.

Look for Sales

If you already know what you want to buy for your spouse, kids or a special friend, keep an eye out for sales. You can often save 10 percent or more if you wait for sales. Knowing what you are getting, instead of wandering around the store trying to figure out what to get, also allows you to look for the best deal if the item does not go on sale.

Shop Online

You can often find better deals online since you can compare several sites at once. And many online stores offer coupon codes that you can’t use if you go to the store in person. Finally, you don’t have to limit yourself to a store you can drive to. Another state might have the item you are looking for at a much lower price.

When shopping online, always be sure the store is legitimate if you are using a smaller store. Look for a return policy, phone number and physical address. Sites that do not post contact information or return policies are “fishy.”

Additionally, shop for holiday dinners now. You can pick up items that can be frozen, such as ham and turkey, when they do on sale. If you use canned vegetables, grab a few cans when they go on sale. You won’t be stuck without a big dinner if you plan for the holiday meals ahead of time.

When you apply these tips, you are sure to have a great holiday season.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

BENEFITS OF DEBT SETTLEMENT: PROTECTING CONSUMERS, CREATING JOBS AND STIMULATING THE ECONOMY

Despite significant economic improvement in 2021, consumer debt in the U.S. has once again hit an all-time high. By the first quarter of 2022 it climbed to $15.83 trillion – more than double what it was in 2003 and 20.9% higher than the total pre-pandemic.

In these uncertain times, relief through debt settlement is an essential service. Below are a few things you should know about the debt settlement industry and how it can positively affect the consumer as well as the economy.

Watchdogs of the Debt Settlement Industry

The industry is federally regulated under the watchful eye of the Federal Trade Commission (FTC). Likewise, the American Fair Credit Council (AFCC) is an alliance that creates standards and guidelines to improve compliance, transparency and consumer advocacy within the industry.

Together, these organizations help prevent disreputable companies from manipulating consumers and provide accredited members with important updates and information. Only reputable companies can be accredited by the AFCC. The FTC takes complaints against deb settlement companies seriously.

AFCC Code of Conduct Highlights

- No Upfront fees

- Fee Transparency

- Fair and Reasonable Fees

- Good Faith Communication

- Upfront Disclosure of Program Risks and Benefits

- Zero Compensation from Creditors

- No Exaggerated Claims

- Program Cost and Duration Estimates Based on Real Data

The Debt Settlement Industry Offers Significant Contributions to the Economy

n addition to being one of the most consumer-focused financial services available, the benefits of debt settlement positively impact the economy.

When people move beyond crippling debt, they can spend more of their hard-earned money in the local economy, supporting small businesses and investing in their communities.

Debt Settlement Helps People Who Are Struggling With Debt Avoid Bankruptcy

Debt Settlement is one of the few reliable alternatives to bankruptcy. Many who qualify for settlement programs are ineligible for other forms of debt relief like debt consolidation loans. Keeping the option legal and accessible helps consumers who feel they have nowhere else to turn and puts them on a path to recovery.

Creditors Who Work With Debt Settlement Companies Benefit From the Program Too

Creditors participating in settlement programs in 2019 received more than $658 million in revenue that might otherwise have been delayed or not received at all. Although debt settlement companies and creditors are not necessarily allies, they are not adversaries.

Debt settlement companies have strong, good-faith relationships with creditors that allow them to negotiate fair settlements that are a win for both the consumer and the creditor.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!

Children are notoriously curious. And as most parents find out at inopportune times, giving age-appropriate, honest answers to a question about an adult issue can be tricky. This is especially difficult if the child’s question exhibits a healthy inquisitiveness – something to be encouraged, not repressed. You want to avoid shutting down a child’s healthy curiosity because you are either ill-prepared or uncomfortable talking about it yourself.

So, when the questions about money and finances pop up and, rest assured, they will, it is best to be prepared. Seize the moment as teachable, one you can use to help prepare your kids to be self-sufficient, successful adults.

Why is it Important to Talk to Kids About Finances?

Having ongoing, honest conversations about finances with curious children will help them approach adult financial issues with openness, knowledge, and a willingness to ask for help when needed. Parents should recognize that children may not be old enough (or have the necessary life experience) to understand certain financial concepts.

Children learn best from a positive experience with a trusted adult rather than an ad hyped on TV.

A recent OnePoll survey of parents with kids aged eight to fourteen revealed that more than eight out of 10 would have preferred if their parents helped them learn about finances while growing up. About 13% of the respondents noted they had no financial education as kids.

Consider these suggestions when deciding how to talk finances with your children. But don’t be surprised when they know more than you think.

Answer the Question at an Age-Appropriate Level

A confusing answer has no educational value. And a response that causes discomfort may cause unnecessary distress, which is counterproductive to the original goal of teaching the child about finances.

Be Honest

Share age-appropriate past decisions that resulted in an unfavorable outcome. Explain to them how you wish, in hindsight, that you had considered a more well-thought-out choice. In addition to teaching children how to avoid rookie financial mistakes, your honesty (and willingness to be open) will help build a stronger relationship that can last a lifetime.

Talk Financial Concepts, Not Exact Figures

Teaching children about money and finances is not about disclosing personal financial details. Talking to kids about money and finances is a way to introduce important concepts (i.e., budgeting savings, paying down outstanding debt, and charitable giving). These concepts provide the essential life skills children need to navigate the world towards their personal and career goals.

There are various apps (some offered at no cost) to introduce a real-world budget while teaching them to use it if they are old enough to understand. As they become adults, this simple gesture provides a financial jump-start to keep them ahead of the curve as they enter college.

A Solid Financial Foundation is Among the Best Gifts You Can Give a Child

Perhaps the best lesson that can be imparted to a young mind is that the difference between a goal and a dream is that a plan defines a goal, and a dream exists without an actionable plan.

And to reach financial goals, one must have a plan, which typically requires short-term sacrifices to meet long-term goals.

So, if you are ready, start a conversation about finances with a young, impressionable mind who has yet to develop bad habits. But keep it simple, generic, and age-appropriate. In time, they will trust that they can come to you with money and other important questions. And, if you can be honest and lead by example, your kids will smile in appreciation, at a future date, for your wise parenting decisions.

Contact Century to Learn About Debt Settlement

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

If debt settlement sounds like it might be the right debt reduction strategy for you, contact Century Support Services. Century has helped hundreds of thousands of people settle debts that they otherwise couldn’t pay, and has saved clients a lot of time, aggravation and money in the process. To date, Century has settled more than $1.3 billion in debt and maintains a 94% satisfaction rating.

To get started, you’ll receive our free assessment and our Certified Debt Specialists will create a personalized program plan for you.

To learn more about the debt settlement process or if you have any general questions relating to how long does debt settlement take or how long will it take to recover from debt settlement, we’re happy to answer any questions.

Contact us today!