Debt Relief Programs in New York

Many New York residents are burdened by large monthly debt payments and sizeable outstanding balances. Credit card debt, personal loan debt, car debt, medical debt and other forms of debt can make positive financial progress impossible, and even meeting monthly obligations becomes challenging in many cases.

While some residents who are in these types of situations declare bankruptcy, filing bankruptcy is often not the only possible solution. A debt relief program may offer another way out of unbearable debt.

Debt relief programs for New Yorkers are made available to almost anyone who struggles with debt payments. Debt settlement companies servicing New Yorkers have programs to assist with credit card debt relief, car debt relief, medical debt relief and other forms of debt.

If the above circumstances describe your situation, find out how a New York focused debt settlement program could help you.

What is New Yorker Debt Relief?

New Yorker debt relief is a way out of debt for any residents who struggle under the financial burdens of credit cards, unsecured loans or outstanding bills. The goal of debt relief is to relieve the pressure that unmanageable debt causes, by either lowering monthly payments and/or lessening the total debt load.

One of the most common New York debt relief options is debt settlement. New York targeted-debt settlement programs temporarily stop payments on outstanding unsecured debts while a participant saves up a manageable amount each month. The savings are held in an FDIC insured savings account, and the company uses those savings to negotiate settlements on the outstanding accounts. The debt negotiation tactics used typically have participating pay off their qualifying debts for less than is actually owed.

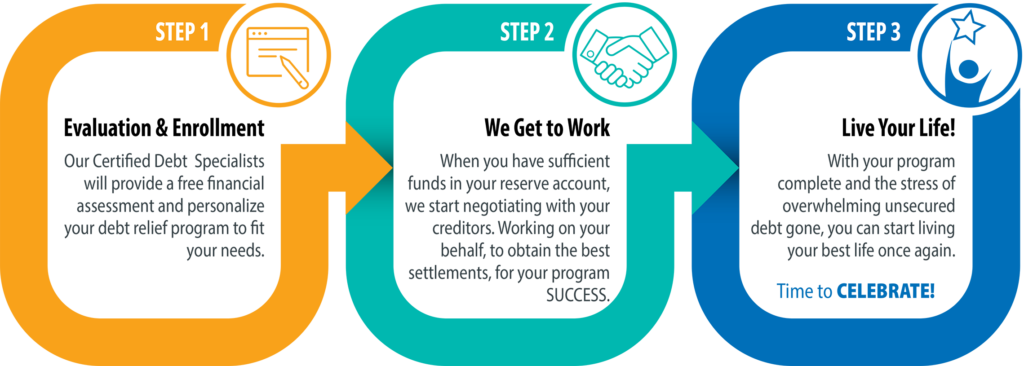

It's As Easy As 1, 2, 3 ...

Century’s focus is completely on you.

We are experienced in helping our client’s get on a path toward better financial health. Check out our easy, three step program below.

Will a Debt Relief Program Hurt My Credit Score?

Debt relief programs will likely impact your credit score, because your score is largely based on your outstanding debts, debt utilization, payment history and similar factors. Debt settlement that involves debt negotiation will almost certainly affect your credit, but the affect will be much less than that of a bankruptcy. Additionally, you can usually begin to reestablish your credit shortly after completing a debt settlement program. The actual impact on people’s borrowing abilities is normally quite manageable.

In New York is Debt Relief Legitimate?

Century Support Services offers a well-established debt relief program that many people have successfully followed. When choosing a program, you should look for an organization that has a proven track record in New York and helped eliminate millions of dollars in debt. To learn more about what Century has done, check out their clients’ stories.

Benefits of Debt Settlement

The primary benefit of debt settlement (or any debt relief program) is regaining control of your finances. Debt settlement, specifically, has several distinct advantages:

Select a monthly payment that’s manageable for you

Pay off outstanding debts for less than is owed

Let a professional handle debt negotiations

Reduce or eliminate your debt load

With a 95.4% customer satisfaction rating, Century Support Services has settled over $1.3 Billion in debt, across more than 250,000 clients. We have the resources and the expertise to resolve your financial burdens.

Frequently Asked Questions about Debt in New York

Debt and Financial Resources for New York Residents

Century Can Help New Yorkers Struggling with Debt

If you are a New York resident who needs help with credit card or other types of unsecured debt, contact us to see if you qualify.