Does the IRS Still Owe You Extra Money?

Posted by Century Support Services on Oct 30, 2020

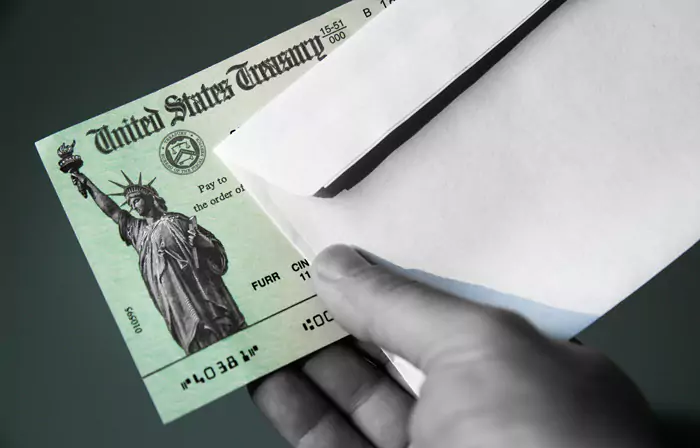

Typically, the income tax deadline falls on or around April 15. Because of the coronavirus pandemic, Americans faced a somewhat different experience in 2020. For millions of people, that might even include getting a surprise check in the mail from the IRS.

Does the IRS Owe You Some Extra Money?

This year, the government extended the typical tax deadline from April 15 to July 15. That meant that millions of taxpayers didn’t even file until after the normal due date. Filing later would also result in getting refunds back later. Typically, the IRS only pays interest on tax refunds if it takes them more than 45 days from the filing date to pay. For 2020, the IRS will generously calculate interest from the filing date and not wait 45 days.

According to AARP, almost 14 million taxpayers can expect to get an extra payment to cover the interest. Legally, anybody who filed their taxes between April 15 and July 15 could qualify for interest on their refund amount. The IRS has said that average checks only total about $18, but it’s still good to know where the extra payment came from.

The IRS might pay this interest in a couple of different ways:

-

Most people have enrolled in direct deposit for refunds, so they’ll get their interest payments the same way by August 19.

-

People who haven’t given the IRS direct deposit information will get a paper check with a notation that says “INT Amount.”

What’s the Catch to These Extra Interest Payments?

Of course, there’s a small catch to these interest payments. The IRS considers them taxable income, so people who received the interest check might also get a 1099 for their 2020 taxes in the mail. Since average checks are pretty small, the payment probably won’t impact most people’s taxes that much. At the same time, it’s good to keep an eye out for a 1099 that might prove as unexpected as the payment was in the first place.

Are Taxes Taking Longer to Process?

As for typical tax returns, the IRS issued a bulletin in August encouraging taxpayers to use electronic filing methods if at all possible. They said that they will process paper returns in the order of receipt; however, they will take longer to process because of coronavirus-related delays.

The IRS also added that IRS.gov, the official website, remains the best source of information about tax status and urged people not to call with questions about the status of their returns. They cautioned people not to file a second return electronically if they already filed a paper return the second time.

Are You Owed a Stimulus Payment?

Totally different than tax refunds, the government sent stimulus payments of $1,200 to millions of Americans. Officially called Economic Impact Payments, the IRS distributed them back in April. They may have arrived via direct deposit, checks, or debit cards. If the payment did not arrive, people can use this IRS tool to track the money down or to request it.

As an example, some elderly people on fixed incomes may not need to file because their income is below the filing threshold. For them, the IRS could have used the payment method they already have established for Social Security. However, people who do not get government benefits or have a deposit account on file with the IRS may need to file a 2019 tax return in order to receive their payment.